Review of Rostov-on-Don Beer Market

The year of 2004 was quite a challenge for Russian brewers: at the beginning of the year the excise rate increased by 25%; in April beer with alcohol content over 8% was attempted to be referred to alcohol drinks; August brought amendments to the law "On Advertising"; and in December the law limiting retail sales and public consumption of beer was adopted. To make things even worse restriction to use images of people and animals in beer advertisements is coming into effect in January 2005. All this makes launch new trademarks fairly complicated.A lot of experts and analysts are predicting stagnation of the brewing industry in the nearest future because the simultaneous excise rise, reduction of retail trade outlets and restrictions on advertisements cannot but tell on the industry development. However, are we really to see decline and stagnation or maybe we are to expect some qualitative change of the market?

From 1998 to 2004 Russian brewing industry was performing under very favorable conditions as beer was not legislatively referred – neither it is now – to hard alcohol. Accordingly, the excise policy applied to brewers was softer than that applied to alcohol producers. There were no restrictions on any kind of advertising including TV broadcasting, which made beer the only widely advertised product in the category of alcohol-containing beverages. As a result, beer market in Russia was rather driven be interests of manufacturers than consumers. Today investigation of beer market is of special interest as it allows shows the industry in the period of transition to new conditions of development.

In July 2004 "Alliance Major" conducted a research of Rostov-on-Don market of bottled beer. The research method was retail-audit. The quota sampling regarding the trade outlet type included 107 retail enterprises. The research was conducted in the period of seasonal growth of the sales activity.

At the moment of the monitoring Rostov-on-Don retail offered 186 beer brands and varieties, 116 of them being domestic beer, 36 - license beer and 34 - imported beer. There were 76 beer trademarks available in sales – 35 domestic, 19 license and 20 imported beer trademarks.

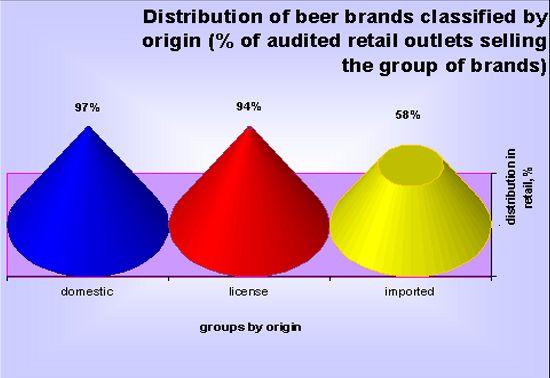

According to research results, domestic beer was offered by 97% audited retail outlets, license beer – by 94% and imported beer – by 58%. Category of imported beer included Ukrainian product which was offered by 50% of audited retail outlets. Beer imported from other foreign countries (not CIS) was available in 29% of audited retail outlets.

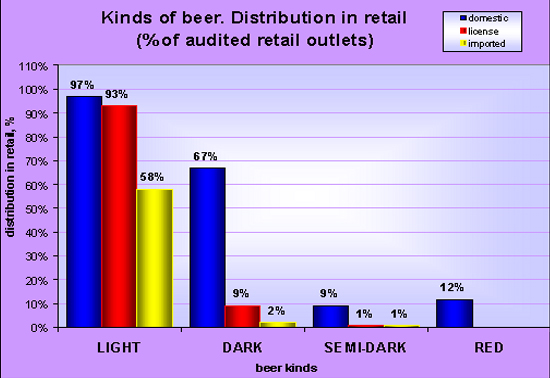

Light beer mainly drove the sales: distribution index of domestic light beer was 97%; meanwhile distribution of license light beer accounted for 93% of audited retail outlets, and of imported light beer - for 58%. Dark beer in Rostov retail is mainly represented by domestic brands, distribution of this category accounted for 67%. Red domestic beer offered by 12% of audited retail outlets was represented just by one brand – "Klinskoye REDkoye" ("Klinskoye Rare") by "Ob’edinennye Pivovarennye Zavody (Consolidated Breweries)" OJSC (Klin).

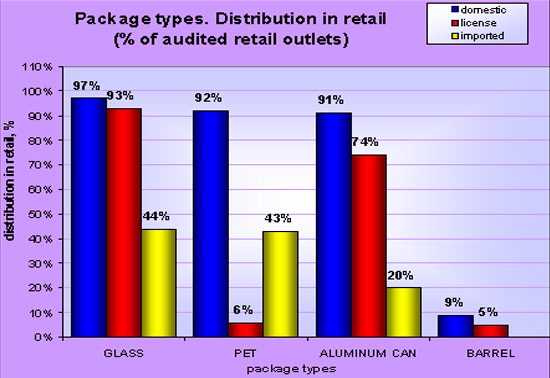

Domestic manufacturers demonstrated no special preferences for package types: distribution indices of domestic beer in glass, PET and aluminum showed insignificant differences and accounted for 97, 92 and 91% respectively. License beer was mostly available in glass and aluminum – distribution of these types of containers was 93 and 74% respectively. Major part of imported beer was sold in glass and PET – distribution indices 44 and 43% respectively. Noteworthy, glass bottles mainly contained beer imported from other than CIS foreign countries while beer in PET containers was supplied by Ukraine.

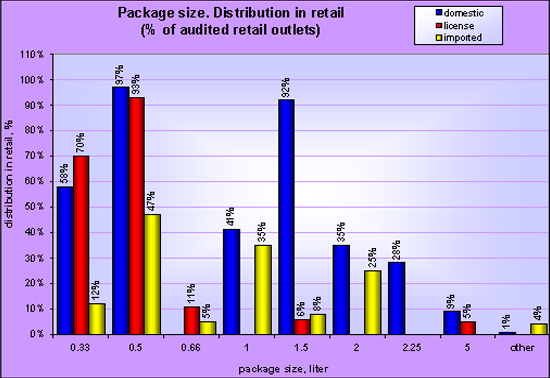

The most popular package sizes of domestic beer were 0.5 and 1.5-liter – they were available in 97 and 92% of audited retail outlets respectively. The 0.33-liter package was available in 58% of retail outlets. License beer was mostly sold in 0.5 and 0.33-liter packages – distribution was 93 and 70% respectively. Imported beer was mainly sold in 0.5, 1 and 2 liter containers which were offered in 47%, 35 and 25% of trade outlets respectively. It should be mentioned that 1-liter bottles were mostly used by Ukrainian beer while 2-liter package was used by Ukrainian beer only. Imported beer in 0.33-liter containers was offered by 12% of audited retail outlets, this package size was peculiar mainly for beer imported from other than CIS foreign countries.

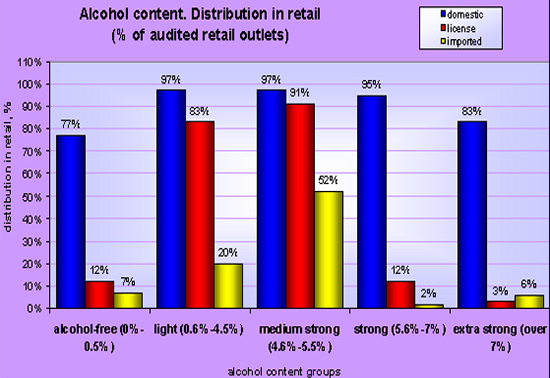

Rostov-on-Don retail sells beer of 40 different grades of alcohol content ranking from 0 to 8.6%. For analysis convenience we classified beer into 5 groups: alcohol-free (alcohol content 0 to 0.5%), light (0.6 to 4.5%), medium strong (4.6 to 5.5%), strong (5.6 to 7%) and extra strong (alcohol content over 7%). In segment of domestic beer all five groups had almost equal distribution indices: light and medium strong beer was available in 97% of trade outlets, strong beer – in 95%, extra strong and alcohol-free beer were available respectively in 83 and 77% of audited retail outlets. Most typical strength grades of license beer were medium strong and light – distribution indices 91 and 83% respectively. Imported beer in Rostov retail was mostly medium strong – distribution index of this group was 52%.

So, according to research data, the most widely available beer in retail of Rostov-on-Don was domestic light brands, low or medium strong, bottled into glass or PET 0.5 and 1.5 liter containers. Meanwhile license light medium-strong beer in glass 0.5 liter containers also demonstrated fairly good distribution in retail.

Special attention should be paid to the fact that segment of domestic beer demonstrated no preference for any of the said parameters. For example, the difference between distribution indices of various package types was insignificant: 5% between indices of glass and PET containers and 6% between indices of glass and aluminum containers. For comparison, difference between distribution indices of license beer in glass and aluminum was 19%. The same situation was observed about alcohol content: distribution indices of light and medium strong beer were 97% each, of strong beer - 95%. Compare: medium strong license beer was available in 91% of trade outlets, light – in 83%, strong – in 12%; distribution of medium strong imported beer constituted 52%, of light and alcohol-free – 20 and 7% respectively. Such market structure is peculiar for "manufacturer" type of market and Russian beer market is exactly this type today.

Analysis of such aspects of beer brand performance as average price and distribution in Rostov-on-Don retail revealed no correlation between these parameters. This means that availability of beer brands in retail was rather related to manufacturer’s marketing and distribution policy rather than to consumer preferences. In terms of distribution in retail the leaders among domestic brands were: "Don Classicheskoe (Classic)" available in 83% of trade outlets and also "Baltika (Baltic) N 3" and "Don Yuzhnoye (South)" (all brands of "Baltika-Rostov Brewing Company" OJSC, Rostov-on-Don) – 75% of retail trade enterprises each. The leader among license brands was "Stella Artois" ("Kaluzhskaya Brewing Company" LLC, Kaluga) with distribution index 51%. The most widely available imported beer brand was "Obolon Lager" ("Obolon" CJSC, Ukraine) which was offered by 30% of audited retail outlets.

| Brands/varieties | Distribution in retail, % | Average price, Rb/liter |

| Don Classicheskoe | 83% | 24,33 |

| Baltika N 3 | 75% | 33,07 |

| Don Yuzhnoye | 75% | 25,27 |

| Baltika N 9 | 70% | 36,73 |

| Klinskoe Light | 67% | 31,61 |

| Baltika N 0 | 66% | 40,60 |

| Nevskoe Classicheskoe | 59% | 42,19 |

| Arsenalnoe Traditsionnoe | 58% | 24,42 |

| Don Stanichnoe | 58% | 21,44 |

| Baltika N 5 | 57% | 38,84 |

| Nevskoe Light | 55% | 40,87 |

| Baltika N 7 | 51% | 41,43 |

| Beliy Medved Light | 50% | 24,76 |

| "Stella Artois" | 51% | 71,52 |

| "Efes Premium" | 43% | 50,24 |

| "Tuborg" | 43% | 54,20 |

| "Miller" | 36% | 78,83 |

| "Carlsberg" | 34% | 49,16 |

| "Velkopopovicky Kozel" | 30% | 42,46 |

| "Stary Pramen" (eeanne?aneia) | 30% | 60,83 |

| "Gosser" | 29% | 65,45 |

| Obolon Lager | 30% | 28,85 |

| "Beck's" | 21% | 53,06 |

| Obolon Magnate | 19% | 35,81 |

| Obolon Premium | 18% | 30,03 |

| Obolon Light | 14% | 23,61 |

Interesting enough, average prices of most popular beer brands and average prices of manufacturers of these brands differ by no more than Rb5. Thus it is obvious that manufacturers work in one price category avoiding price competition inside their brand portfolios.

In segment of domestic beer the maximum distribution in Rostov retail was demonstrated by "Baltika-Rostov Brewing Company" OJSC (Rostov-on-Don) and "Consolidated Breweries" OJSC (Klin) – products of these breweries were available in 93% and 90% of audited retail outlets respectively. "Kaluzhskaya Brewing Company" LLC (Kaluga) was the leader in segment of license beer with distribution index 67%. "Obolon" CJSC (Ukraine) and "Brauerei Beck GmbH & Co" (Germany) were on the first lines in segment of imported beer with distribution indices 50% and 21% respectively.

| Manufacturer | Distribution in retail, % | Average price, Rb/liter |

| "Baltika-Rostov PK" OJSC, Rostov-on-Don | 93% | 28,13 |

| "OPZ" OJSC, Klin | 90% | 34,15 |

| "Vena" OJSC, Saint Petersburg | 76% | 42,89 |

| "Moskva-Efes PK" CJSC, Moscow | 75% | 35,28 |

| "Baltika-SPb PK" OJSC, Saint Petersburg | 63% | 34,62 |

| "Ochakovo" CJSC, Krasnodar | 62% | 22,45 |

| "Kaluzhskaya PK" LLC, Kaluga | 61% | 36,18 |

| "Ivan Taranov PK" CJSC, Novotroitsk | 47% | 34,23 |

| "Povolzhie" OJSC, Volzhskiy | 38% | 21,80 |

| "Chastnaya Pivovarnya Tinkoff" LLC, Saint Petersburg | 34% | 91,36 |

| "Pivovarnya Heineken" LLC, Saint Petersburg | 33% | 34,54 |

| "Krasniy Vostok-Solodovpivo" OJSC PO, Kazan | 32% | 27,56 |

| "Amstar" OJSC, Ufa | 27% | 31,03 |

| "Pivovarnya Doroshenko" IB, Rostov-on-Don | 12% | 74,77 |

| "Pivovarnya Efes" CJSC, Rostov-on-Don | 11% | 34,83 |

| "Baltika-Khabarovsk PK" OJSC, Khabarovsk | 11% | 23,04 |

| "SUN-Interbrew Vozhskiy" OJSC, Volzhskiy | 11% | 44,04 |

| "KB-SibPiv Kompaniya" CJSC, Novosibirsk | 8% | 17,07 |

| "Baltika-Samara PK" OJSC, Samara | 4% | 25,39 |

| "Yarpivo" OJSC, Yaroslavl | 4% | 32,95 |

| "IPK" CJSC, Ivanovo | 3% | 36,33 |

| "Baltika-Tula PK" OJSC, Tula | 1% | 38,50 |

| "Aksay-Pivo" LLC, Aksay, Rostov region | 1% | 22,13 |

| "Kaluzhskaya PK" LLC, Kaluga | 67% | 63,05 |

| "Moskva-Efes PK" CJSC, Moscow | 58% | 52,26 |

| "Vena" OJSC, Saint Petersburg | 56% | 53,76 |

| "OPZ" OJSC, Klin | 51% | 71,52 |

| "Pivovarnya Heineken" LLC, Saint Petersburg | 35% | 64,22 |

| "Ivan Taranov PK" CJSC, Kaliningrad | 34% | 61,19 |

| "Bavaria PZ" OJSC, Saint Petersburg | 25% | 81,44 |

| "Baltika-SPb PK" OJSC, Saint Petersburg | 21% | 50,06 |

| "Cheshskiy Standart" OJSC, Kazan | 21% | 31,55 |

| "Baltika-Rostov PK" OJSC, Rostov-on-Don | 13% | 47,35 |

| "Ochakovo" CJSC, Moscow | 7% | 55,48 |

| "Russkie Traditsii PK" CJSC, Moscow | 2% | 105,73 |

| "Obolon" CJSC, Kiev, Ukraine | 50% | 29,83 |

| Brauerei Beck GmbH & Co, Bremen, Germany | 21% | 53,06 |

| Grupo Modelo, Colonia Anahuac Mexico DF, Mexico | 8% | 128,06 |

| "Sarmat" CJSC, Donetsk, Ukraine | 8% | 29,02 |

| Pivovar Zlaty Bazant a.s., Republic of Slovakia | 7% | 124,13 |

| The Danish Brewery Group, Denmark | 5% | 117,74 |

| Brau Zipf, Brau Union Osterreich AG, Austria | 4% | 145,80 |

| Guinness Ireland Group LTD, Ireland | 4% | 187,22 |

| Gabriel Sedlmayr Spaten-Franziskaner-Braeu KgaA, Munchen, Germany | 3% | 86,40 |

| "Slavutich KPB" OJSC, Zaporozhe, Ukraine | 3% | 38,70 |

| Budweiser Budvar N.C., Czech Republic | 2% | 107,00 |

| Foster's Brewing Group Limited, England | 2% | 136,36 |

| Brauerei Paulaner, Munchen, Germany | 2% | 136,89 |

Average price of domestic beer in Rostov retail constituted Rb34.68 per liter, of license beer – Rb59.23 per liter, and of imported beer – Rb54.46 per liter. It should be mentioned that price of Ukrainian beer accounted for Rb29.89 per liter while the price of beer imported from other than CIS foreign countries was Rb111.01.

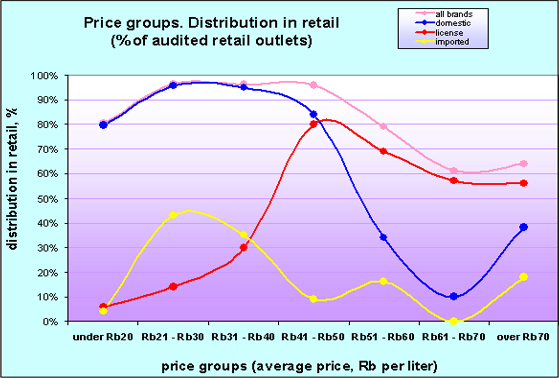

Distribution of bottled beer in Rostov retail revealed price polarization recently observed on the majority of consumer markets: decrease of medium-price segment on the background of increasing low-price and high-price segments. This trend was most vividly exemplified by domestic beer: distribution index of premium beer constitutes 40% with just by two manufacturers operating in the category – "Chastnaya Pivovarnya Tinkoff (Private Brewery Tinkoff)" LLC (Saint-Petersburg) with the brand "Tinkoff" and "Pivovarnya Doroshenko (Brewery of Doroshenko)" IB (Rostov-on-Don) with the brand "Berlinskoye".

Price segmentation of imported beer was quite predictable: low-price segment was occupied by Ukrainian beer while beer imported from other than CIS foreign countries was concentrated in high-price segment; in medium-price segment offer was almost zero.

License beer showed somewhat different picture: offer was fairly generous and almost equal in medium-price and high-price segments. This is quite logical because license brewed beer under is as a rule top quality or highly popular – or either – and thus cannot be cheap. A good match expensive license beer is premium imported beer.

Thus, today Rostov market of bottled beer is "manufacturer" market with such peculiarities as excessive offer, poor differentiation of segments (beer kinds, alcohol content, package types and size); poor price differentiation of manufacturers’ brand portfolios; determination of retail offer rather by manufacturer’s distribution and marketing policy than by consumer preferences. "Antibeer" laws introduced in 2004 return beer brewing industry back to "natural economic selection" – situation when consumer demand determines market performance. This cannot but accelerate competition between manufacturers. Even brands of the same manufacturer might turn into rivals. Thus, the number of beer brands in retail offer is forecasted to reduce and brewing companies will have to change their tactics of sales maintaining through permanent launches of novelties.

In the nearest future increase of retail prices for domestic and license beer can be anticipated. Further on low-price and premium categories will be more polarized. Limited advertising freedom on beer market might lead to appearance of "umbrella" brands. Large brewing companies can come to sector of "live" beer: industrial brewing of production of such beer is not profitable however licenses for production technology of premium brands to small restaurant breweries can be promising. Whatever changes this market suffers the winner is consumer. And of course beer.

Nina Krympenko,

Senior market analyst